How to achieve Financial Independence for an early retirement?

The desire to become financially independent has been increasing in recent times. There is a lot of buzz amongst the millennials for financial independence to retire well before the traditional retirement age of 55 to 65 years.

But before we move on to the process of becoming financially independent, we need to understand the exact meaning of ‘Financial Independence”.

Financial independence refers to a state of having enough ‘passive income-generating resources’ at our disposal to meet our expenses as well as fulfill our future financial goals.

Why is there a need for financial independence to retire early?

Some people work for their passion, however, for most of the people working is a necessary evil. We look for early retirement to gain the flexibility to choose how we spend the rest of our lives.

Freedom & Fulfilment

Some people believe that early retirement will enable them to travel and spend time with family. Some want to discover new aspects of life, some want to achieve fulfillment by writing books, teaching, pursue art, learn new skills, etc. This is a powerful motivator for the younger generation to save money at an early stage in their careers.

Healthier lifestyle

However, leisure is not the only reason for opting for early retirement. Some people want an early retirement from jobs that cause a lot of stress and can harm their health conditions. Getting out of the unhealthy environment and spending more time on personal growth can also be a big motivation.

Early retirement is a fantastic goal, but it can be tough to achieve. Three major obstacles stand in your way:

- Your current income level is low since you have just started working or are in the middle of your career path and have not reached the peak of your career.

- You have less time to save enough money since you are retiring earlier than the traditional age for retirement.

- You find it difficult to control your unnecessary expenses and spend the majority of your income on luxury.

These obstacles can be easily mitigated if dealt with the right approach. However, it will require serious dedication and diligence. You will require a plan and will need to understand the numbers.

Let’s take a look at the process of achieving financial independence to retire early.

Tracking and categorizing your current expenses

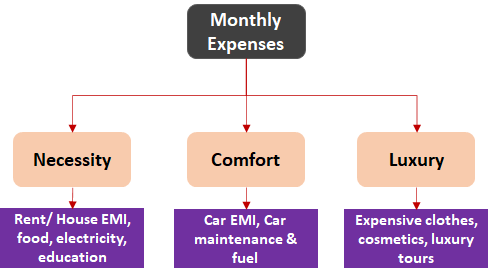

To estimate your fund requirement in the future, you first need to assess your current expense level and categorize the expenses in the following categories:

1. Necessity: Expenses such as rent/ house EMI, food, basic clothing, electricity, education, etc.

2. Comfort: Expenses such as EMI for buying a Car, Car maintenance & fuel, etc.

3. Luxury: Expenses such as buying expensive clothes, cosmetics, luxury tours, etc.

You can track your monthly expenses with the help of the following:

1. Checking your monthly bank account statements

2. Using an expense tracker/ budgeting app

Estimation of your future expenses based on your needs

To estimate how much ‘passive income-generating resources’ you require to retire at a certain age, you need to estimate the future cash of your expenses. The estimation of future expenses can be done by taking your current expenses as the base and using an expense model that takes into consideration the inflation and incremental expenses based on your future needs.

Estimation of Investment Corpus required for financial independence

The investment corpus i.e. ‘passive income-generating resources’ are the investments that you make to generate passive income in the future. These investments can be in the form of financial securities (such as shares, debentures, bonds), real estate assets, fixed deposits, etc.

It is important to diversify the investments and create an investment portfolio to mitigate risks associated with each type of investment. For example, investments in equity shares of a company might generate higher returns but at the same time has a high risk associated due to the volatility in the market and the returns are not stable.

Safer investments like fixed deposits, real estate generate low returns with stable cash inflows in the form of interest/ rental income. It is important to create the right mix of a class of investments to generate good stable returns and safeguarding the principal investment amount.

The estimation of the amount to be invested will depend upon the average return generated by the investment portfolio in the future. Let’s assume you require a monthly income of USD 4,000 (~Rs. 3,00,000) in the future to meet your estimated expenses. To generate a passive income of USD 4,000, you will require an investment corpus of USD 40,000 (~Rs. 30,00,000) with an average return of 10% to meet your future expenses. However, this does not take into account inflation and future incremental expenses.

Therefore, we need a model which gives us an adequate amount of investment corpus taking into account the inflation and future incremental expenses:

Based on the above calculations, we have established the investment corpus that you need to accumulate by the time you retire to become financially independent.

Saving for an early retirement

Now that we have estimated the amount of future expenses and investment corpus required, let us take a look in which we have to create this investment corpus till the time we have to retire. Given below is a model which tells you how much you need to save and invest every month in order to accumulate the desired Investment Corpus for an early retirement.

The fundamental principle to retire early is that the more you save, the sooner you retire. Given below are the ways in which you can increase your savings to achieve the required investment corpus:

1. Invest your savings

In order to maximize your savings, you need to invest your monthly savings so as to reap the benefits of compounding on your savings. The more you save and invest at an early stage in your career, the more your money gets compounded. The power of compounding should not be underestimated. If you invest USD 10,000 (Rs. 7,50,000), compounding at 10 per cent per annum, you will have USD 25,937 (~Rs. 19,50,000) by the end of a decade.

2. Minimize spending.

Scrutinize every spending of yours and avoid spending money on unnecessary luxury items. You need to be conscious of your spending. Conscious spending will allow you to keep a track of your spending goals.

3. Increase your income

You can increase your income by creating multiple sources of income such as working as a freelancer along with your current job, starting a YouTube channel, creating a web blog etc. The goal is to create a sustainable alternate source of income to supplement your main job.