The HDFC-HDFC Bank merger : Unlocking a financial services giant

“As the son grows older, he acquires the father’s business.”

Deepak Parekh, the chairman of HDFC Limited, quoted in the press conference on HDFC and HDFC Bank merger.

HDFC Bank, which is currently India’s leading Bank with a market cap of ~$110 billion, is set to acquire HDFC by way of merger to create a ~$160 billion financial services giant.

Brief snapshot of the proposed merger:

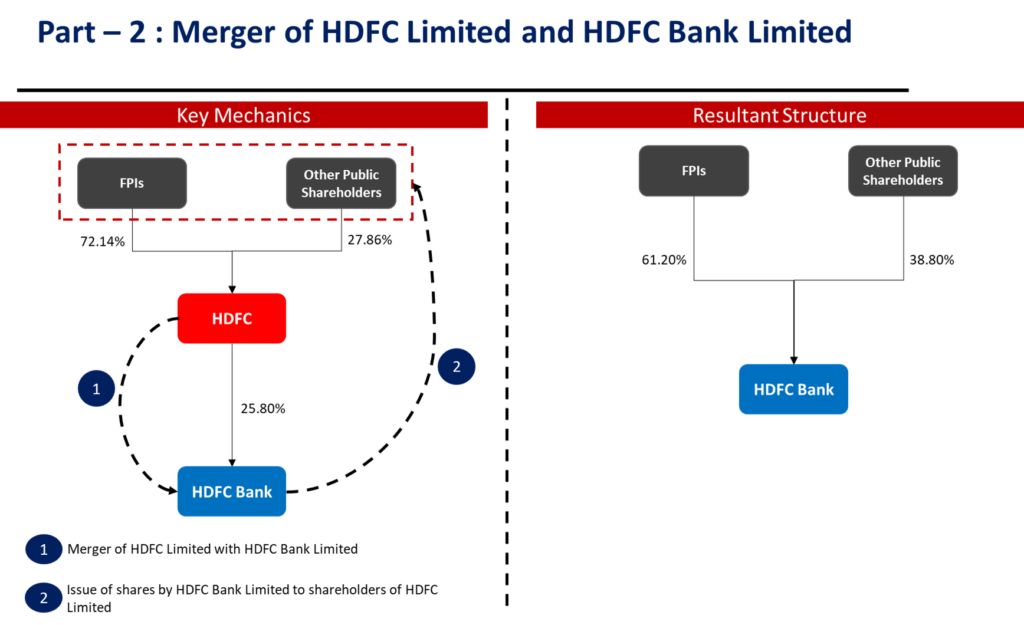

Currently, HDFC Limited is categorized as the promoter of HDFC Bank Limited and holds (together with its wholly-owned subsidiaries) ~25.80% stake in HDFC Bank Limited.

The proposed merger is divided into parts. The first part involves merger of wholly owned subsidiaries of HDFC i.e. HDFC Investments Limited and HDFC Holdings Limited into HDFC, and the second part involves merger of HDFC into HDFC Bank.

- Upon merger of HDFC Investments and HDFC Holdings into HDFC, the investment in HDFC Bank held by HDFC Investments and HDFC Holdings will get consolidated in HDFC.

- Upon merger of HDFC with HDFC Bank, the investments of HDFC in HDFC Bank shall be cancelled and HDFC Bank will issue shares to shareholders of HDFC.

The share exchange ratio for the proposed merger shall be 42 shares of HDFC Bank for every 25 shares of HDFC i.e. HDFC Bank will issue 42 shares for every 25 shares held in HDFC.

The post merger shareholding of HDFC Bank would be:

However, the most important aspect to look for in the proposed merger would be the regulatory approvals since both the entities operate in heavily regulated sectors i.e. banking and lending. Further, HDFC also have investments in insurance companies such as HDFC Life and HDFC Ergo.

Regulatory approvals required for the proposed merger

The proposed merger would require approvals from the following regulators:

- Reserve Bank of India

- Securities and Exchange Board of India

- Competition Commission of India

- National Housing Bank

- Insurance Regulatory and Development Authority of India

- Pension Fund Regulatory and Development Authority

- Stock exchanges – BSE and NSE

Further, it is also interesting to note that after the merger, the total FPI shareholding in HDFC Bank will be ~66% (after taking into account the American Depository Receipts) which is within the limit of 74% set by SEBI.